More people want income sources that continue paying even when they are busy with work, school, or business. Rising living costs and an unstable job market push many people to seek additional income streams that can run quietly in the background.

Passive income gives you breathing space. It helps you cover bills, build savings, and invest for the future without relying on a single paycheck.

Why relying on a single salary is becoming risky

Many industries change quickly. Companies restructure, roles shift, and layoffs happen without much notice. When your income depends on only one source, any sudden change affects your financial stability.

Adding passive income streams helps you:

- Create a backup income

- Reduce financial pressure

- Grow long-term wealth

- Gain more control over your time

What you will learn in this guide

This guide focuses on realistic income streams you can actually start. Some require capital. Others require effort at the beginning. Each one is designed to grow into recurring income over time.

What is passive income?

Passive income is money you continue to earn after the main work has already been done. You either invest money once or invest effort once; once the income starts, it continues with little ongoing work.

Examples include interest from investments, digital products that sell repeatedly, or contest-based earnings where your strategy continues generating returns.

Difference between upfront effort and ongoing effort

Every passive income stream begins with an initial push. After that, maintenance becomes minimal.

- Upfront effort: creating, investing, or setting up systems

- Ongoing effort: small monitoring, occasional updates

Some income streams require capital. Others require skill or time.

How long does passive income take to start paying?

Passive income rarely becomes profitable immediately. Most streams begin paying within:

- Weeks for contest-based earnings or high-yield savings

- Months for digital products or affiliate systems

- Years for real estate or large investment portfolios

Consistency is what turns small earnings into steady income.

How to choose the right passive income stream

Before choosing, evaluate four simple factors.

1. Capital vs time investment

- High capital: investments, real estate

- High time: digital products, content creation

2. Risk level

- Low risk: savings accounts, bond funds

- Medium risk: dividend stocks, fantasy contests

3. Skill requirements

- Minimal skills: savings, ETFs

- Knowledge-based: fantasy sports, digital products

4. Automation potential

Income streams that automate payments, sales, or withdrawals allow you to scale faster.

The 6 passive income ideas to increase your income in 2026

1. High-Yield investments that earn automatically

High-yield investments allow your money to work for you while you focus on other activities.

- High-yield savings accounts: These accounts pay higher interest than traditional bank savings accounts. Your money remains accessible while earning consistent returns. Benefits:

- Low risk

- Stable earnings

- Easy setup

- Automated compounding

- Dividend stocks and ETFs: Companies that pay dividends distribute part of their profits to shareholders. When you hold dividend stocks or dividend ETFs, you receive periodic payouts without selling your shares.

- REITs (Real Estate Investment Trusts): REITs allow you to earn income from real estate without owning physical property. These funds invest in commercial properties and distribute rental profits to investors.

- Bond index funds: Bond funds generate income from interest payments. They are often used for stable, predictable earnings over long periods.

Who this option is best for

This approach suits people who:

- Already have savings

- Prefer lower-maintenance income

- Want long-term growth

2. Fantasy sports

How fantasy sports income works

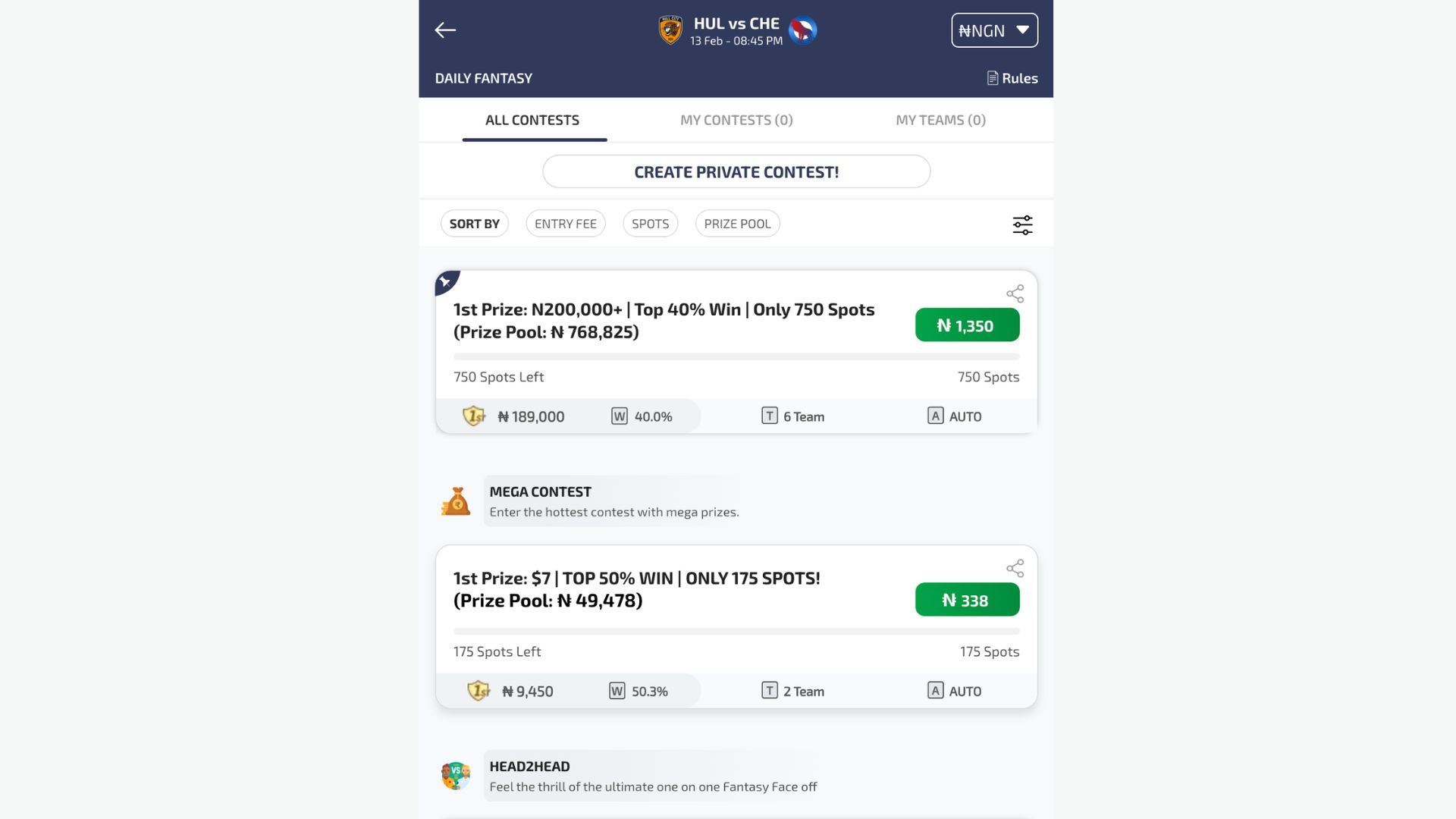

Fantasy sports platforms allow you to create teams made up of real players participating in real matches. Your earnings depend on the performance of the players you select.

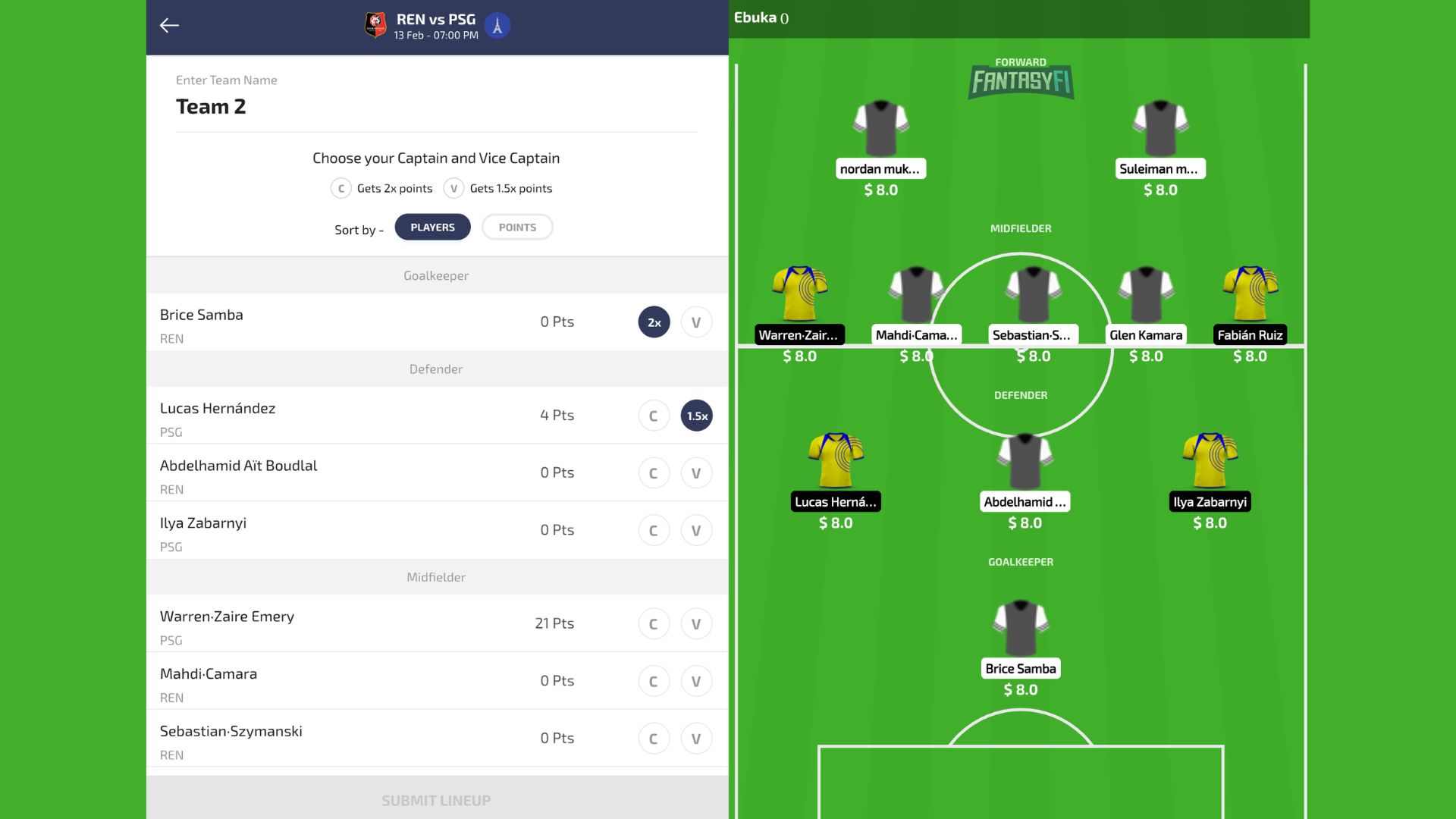

You build a team using a fixed credit budget. Players earn points for real-match actions such as goals, assists, saves, interceptions, and clean sheets. Your team competes with other participants, and the highest-scoring teams win prize pools.

Why prediction contests create recurring earning opportunities

Skill-based contests reward knowledge, research, and strategy. As you improve your player selection skills, your chances of consistent winnings increase. Regular match schedules also create recurring earning opportunities throughout the season.

How FantasyFi contests operate

FantasyFi is a skill-based fantasy sports platform where you create teams of real players and compete for cash prizes.

Here is the basic flow:

- Select a match

- Choose an upcoming match

- Review the contest deadline

- Create your team

- Build an 11-player team within a 100-credit budget

- Select a captain (2x points) and vice-captain (1.5x points)

- Join contests

- Choose free contests or paid contests

- Enter prize-pool competitions based on the entry fee

- Follow the results and withdraw

- Track leaderboard rankings live

- Withdraw winnings directly after contests end

Fantasy points come from real-life performance, such as:

- Goals and assists

- Saves and interceptions

- Clean sheets and match participation

Strategies for consistent participation

Consistent participants often improve their results by:

- Studying player form and recent performance

- Joining contests that match their entry budget

- Creating multiple team combinations

Over time, skill development improves the probability of winning.

Example earning scenarios

A player who joins small entry contests weekly can gradually accumulate winnings across multiple matches. High-performing teams in large contests can earn significantly larger payouts depending on the prize pool size.

Fantasy contests reward skill, analysis, and consistency, making them a recurring source of income for sports fans. Get started now

3. Digital products that sell repeatedly

Digital products require effort once and can be sold thousands of times without additional production cost.

- Templates, planners, and spreadsheets: You can create productivity templates for budgeting, business tracking, or study planning. Platforms like Gumroad or Etsy allow automated delivery after purchase.

- E-books and guides: Knowledge-based guides, tutorials, or niche educational content can generate royalty income each time someone downloads your book.

- Online courses: Recorded courses allow you to teach skills once and earn repeatedly as new students enrol.

- Stock media licensing: Photographers, designers, and videographers can upload creative assets to stock marketplaces and receive recurring licensing payments.

- Automation tools that handle delivery: Most digital product platforms handle:

- Payment processing

- Product delivery

- Customer downloads

- Revenue tracking

This allows your products to continue generating income while you focus on creating new ones.

4. Asset-Based passive income

Asset-based income uses things you already own or can acquire. Once the system is set up, earnings can continue with minimal daily involvement.

- Rental property income: Owning rental apartments or short-stay properties can generate monthly income. Property managers can handle tenant communication, repairs, and rent collection, so your involvement stays limited.

- Crowdfunded real estate: Real estate crowdfunding allows you to invest small amounts into large property projects. The platform manages development, leasing, and distribution of profits while you earn returns from rental income or property appreciation.

- Renting vehicles or equipment: Items that are not used daily can generate income:

- Cars rented through sharing platforms

- Construction tools rented to contractors

- Event equipment rented for ceremonies

- Storage space rented to nearby residents

- Hiring managers to automate operations: When income grows, outsourcing daily tasks helps keep the stream passive. Property managers, fleet managers, or maintenance teams can handle operations while you focus on expanding your assets.

5. Automated online businesses

Online systems can continue generating revenue after setup, especially when payments and delivery processes are automated.

- Affiliate marketing systems: Affiliate marketing lets you earn commissions by recommending products on blogs, social media pages, or niche websites. Once the content ranks or gains traffic, sales can continue without constant promotion.

- Print-on-demand stores: Print-on-demand platforms produce and ship products after customers place orders. You only design the products once, while the platform manages:

- Manufacturing

- Packaging

- Shipping

- Payment processing

- Subscription-based digital tools: Some creators build small digital tools, such as calculators, templates, or analytics dashboards, and charge monthly subscriptions. Recurring billing systems automate revenue collection.

- Email automation funnels: Email systems can automatically send offers, newsletters, or product promotions to subscribers. After setup, the funnel continues converting new visitors into customers.

6. App-Based micro-investment platforms

Micro-investment apps make it easier to invest small amounts regularly. Automation helps build wealth steadily without requiring daily attention.

- Round-up investing apps: These apps round up your everyday purchases and invest the spare change into portfolios. Small contributions accumulate over time and grow through compounding returns.

- Automated portfolio investing: Robo-advisory platforms automatically manage diversified portfolios based on your risk level. They rebalance investments periodically while you track performance from your dashboard.

- Crypto recurring-buy systems: Recurring purchase features allow you to buy small amounts of digital assets automatically at scheduled intervals. This approach spreads risk across different market conditions.

How automation builds long-term passive returns

Automation supports long-term growth through:

- Consistent investing

- Reduced emotional trading

- Compounding earnings

- Minimal daily management

How to combine multiple streams

Building multiple income sources improves stability and reduces reliance on a single channel.

- Layering income streams for stability: Combining different types of passive income creates balance. For example, you can combine investment income with contest earnings or digital product sales.

- Balancing fast-start and long-term income sources: Some streams begin producing income quickly, while others grow slowly but steadily. A balanced approach includes:

- Quick-start income, such as fantasy contests or affiliate earnings

- Long-term income, such as dividend portfolios or real estate

Building your personal passive income portfolio

Start with one manageable income stream, then gradually add others. Track earnings, reinvest profits, and expand the streams that perform best for you.

Final thoughts

Passive income grows step by step. Each stream begins with setup effort and then strengthens over time.

Starting early gives you advantages:

- Compounding returns

- Financial flexibility

- Extra savings opportunities

- Reduced dependence on one income source

If you want a simple way to get started, start earning with FantasyFi. Create your teams, join contests regularly, and build consistent winnings over time. As your earnings grow, you can reinvest them into other passive income streams and continue increasing your income.